Today is a good news story.

The message is simple. Whether at the hands of market volatility or COVID or vexatious co-founders or troublesome investors or just life in general, every startup that makes it to the top will at some point hit rock bottom. If you’re at the bottom or you’ve seen the bottom, it isn’t over yet.

Below I touch on 3 of the greatest early stage ‘turn arounds’ I have seen first hand.

EatClub. Nexl. Canibuild.

Each of them have a very long way to go and no one knows what the future holds but their ability to survive, adapt and now thrive has been nothing short of exceptional.

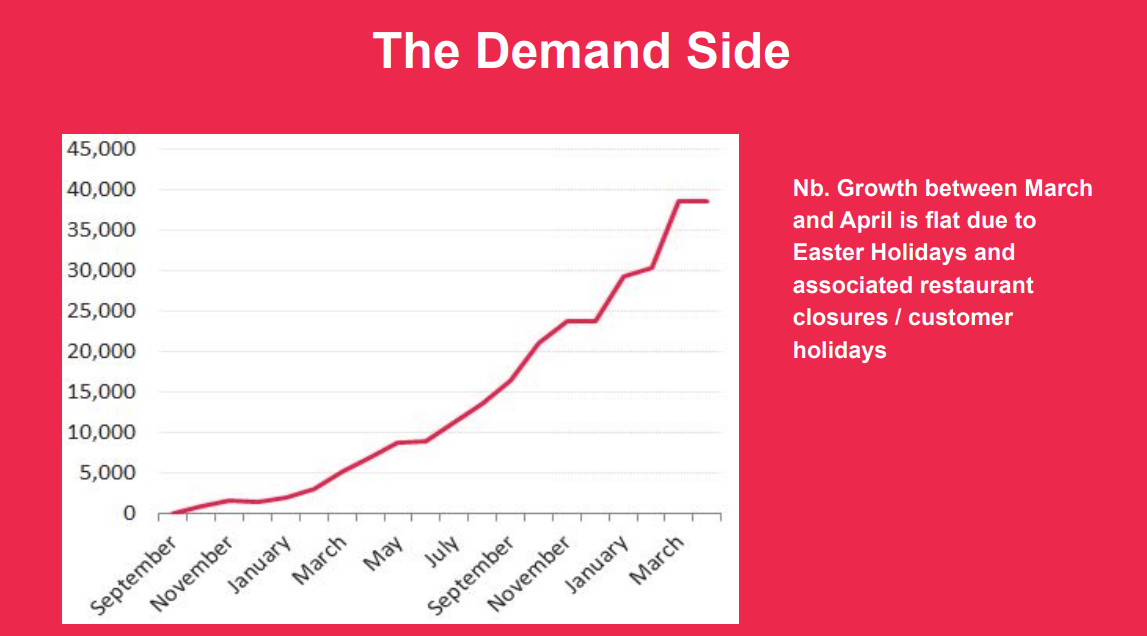

EatClub provides dynamic pricing software for the hospitality industry. At the time that we first invested in 2019, it was one of the fastest growing businesses I had ever seen. This is a slide from the June 2019 board pack…

I will never forget our Feb 2020 board meeting. Pan flew in from the US and as usual put on a good display. It wasn’t until the very last slide that he mentioned:

“CORONA VIRUS?”,

he was just about laughed out of the room.

The business had only recently opened its US operations and the board’s patience for conspiracy theories was limited.

Seven days later he was back at Sydney airport for his return commute:

“This is real”, I said. “We have to close the business.”

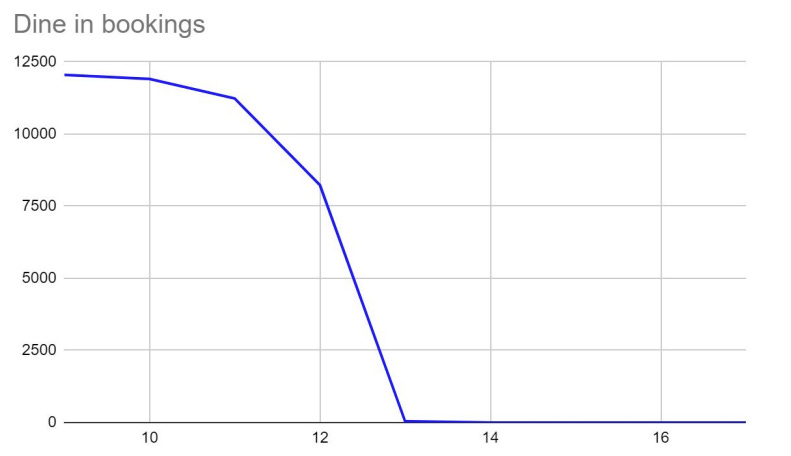

Below is a slide from our April 2020 board meeting showing our weekly dine-in bookings.

For over 2 years Pan and his team earned almost no salaries. Pan spent a lot of this period sleeping on couches and using his dwindling bank account balance to pay a small number of developers that worked tirelessly on the product. I would eventually get used to the unexpected phone call: “do you mind if I stay on your couch when I come to Sydney? We just can’t pay for hotels”.

Unfortunately we had to close the entire US operation and let go of over 75% of our staff across Australia and the US. During that time we closed a number of down rounds under strained circumstances and generally fought for air.

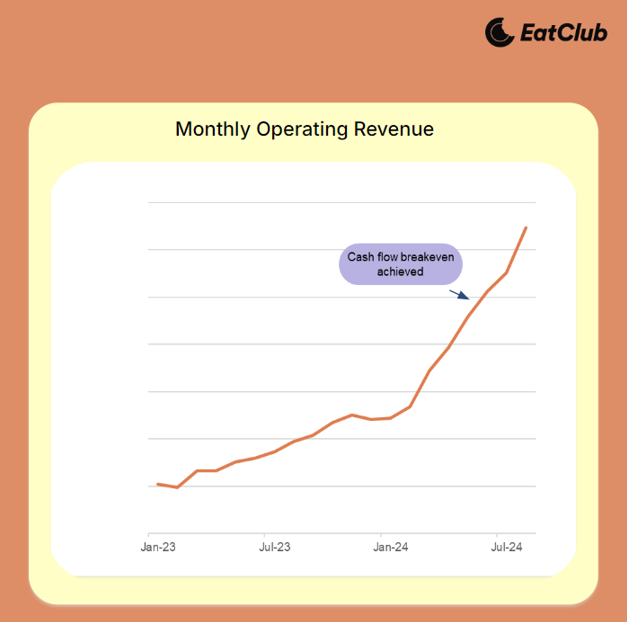

This is a slide from an investor deck we released yesterday.

Today the business is profitable, growing its marketplace revenue at over 150% YoY and generating over $10M ARR.

On average, someone in Australia makes a booking on EatClub every 15 seconds.

We have a LONG way to go but things look a whole lot better than they did before.

If you’re at the bottom or you’ve seen the bottom, it isn’t over yet.

Nexl cab off the rank is Nexl. With founder Philipp Thurner at the helm, Nexl has pulled off one of the few successful pivots I have ever witnessed. To pivot is often synonymous with failure. By its nature, whatever you were doing before the pivot didn’t work out.

Nexl spent around $6M between 2018 and 2023 building the ‘Linkedin for Lawyers’. I have known Phil since then and have always been a huge fan. He’s a deep industry insider and also the sort of person that invariably leaves you smiling whenever you spend time with him; but ‘Linkedin for Lawyers’ was always going to be a difficult sell.

By 2023 the business had closer to $0 of revenue than $1M of revenue and was in survival mode living hand to mouth on the remnants of a prior capital raise. There was but one shimmer of hope sparkling on the horizon. The firms using the platform weren’t willing to pay for introductions but they had become enamored with the CRM type functionality that was a by-product of the platform.

Traditional CRMs don’t cater for lawyers. Sales and marketing teams within law firms focus on long term, ongoing relationships and do not operate with a traditional funnel based model. As a result, CRMs like Salesforce and Hubspot, built around a pipeline view, are incapable of meeting their needs. Traditional CRMs also rely on manual data input to drive actionable insights and in the case of lawyers, the de-facto sales team, there is no one willing to input that data.

Nexl pivoted.

Within 12 months, Nexl had refactored its platform to become a ‘no-data entry’ revenue intelligence tool. It automatically and securely captures all interactions with every participant at a firm. Any email sent or received and any meetings with clients, prospects or referral sources are automatically captured, analysed and transformed into actionable insights geared towards relationship management and ultimately revenue growth.

Today “Linkedin for Lawyers” doesn’t exist (Baruch Hashem) and Nexl is an entirely new business. Its product has virtually no remnants of what it once was. It now services global law firms in over 37 countries and lists MinterEllison, Gilbert + Tobin, Bartier Perry, Al Tamimi and many more top-tier as their clients. The future looks bright for the Nexl of new.

Your capacity for evolution is unlimited.

If you’re at the bottom or you’ve seen the bottom, it isn’t over yet.

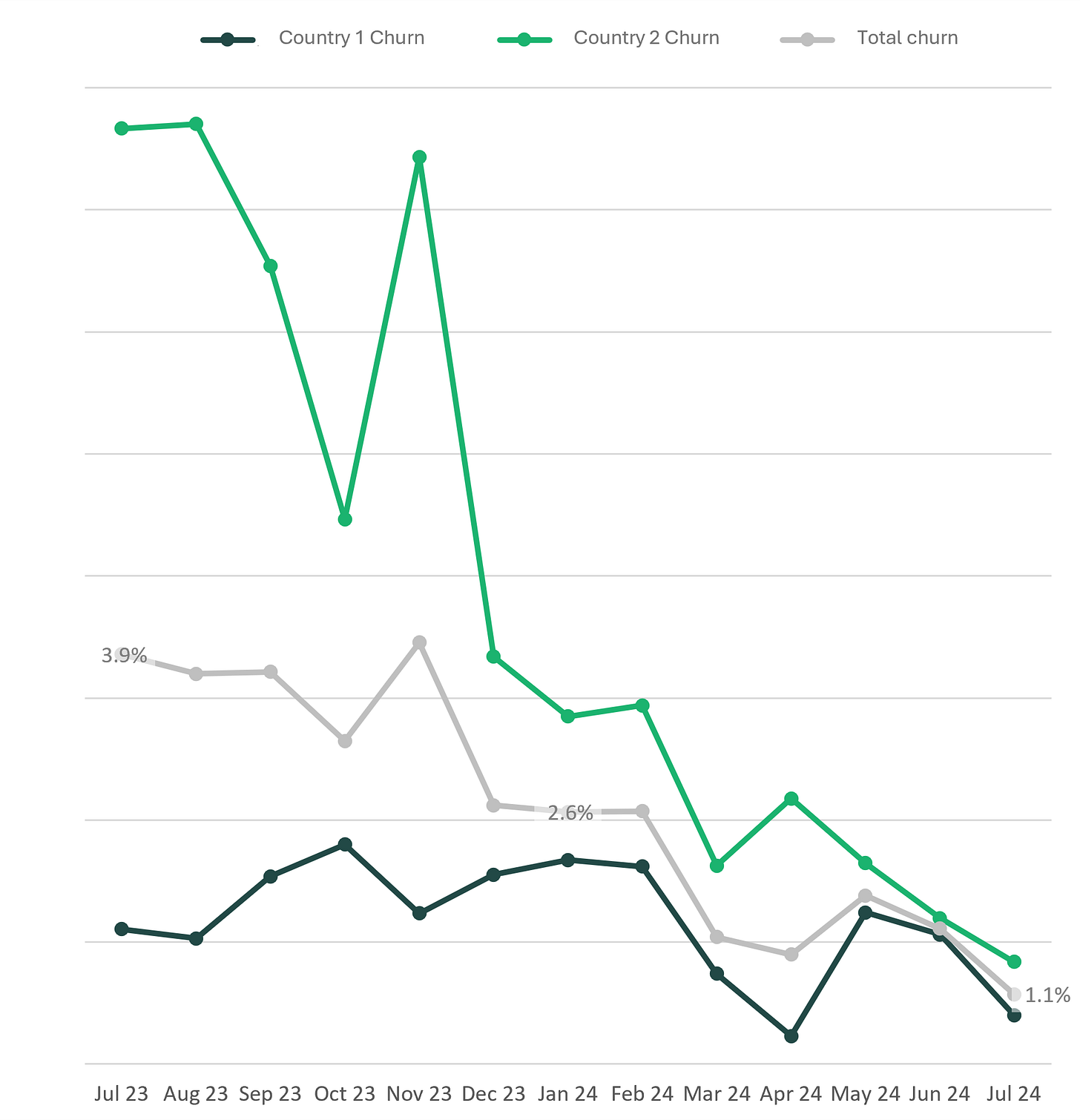

Canibuild from here is one last snippet of recent history - the tale is short and included because it relates to churn (AKA the mother of all evil) which is arguably THE metric we should all care about and often the most difficult metric to improve.

Very often founders know churn is an issue but wait too long to make it a priority. I believe this is because it is more difficult to target than acquiring customers. I encourage all founders to look at churn today and consider if this should be the focus today, before growth.

A while ago we made some missteps at Canibuild and churn spiked, to put it lightly. It just about squashed us but 12 months later the picture is very different. Below is a snippet from our board pack which shows churn reducing by 75% within a 12 month period. This has been accompanied by just about every metric improving dramatically which is hard in a c. $10M ARR business.

The factors that influence churn are cross functional - product, marketing, CS, sales and just about every department has a material impact on churn and as a result improving churn rapidly requires input from every department. Impactful and rapid change like that shown above is only possible where there is whole of business focus. In this case of Canibuild this involved:

redefining its ICP

cutting marketing

rehiring an entire sales team

hiring a senior commercialisation leader

rebuilding the entire CS and on boarding process

changing all sales incentive structures

focusing product on critical ‘quality of life’ elements

Critically, it was the priority for every leader in the business from sales to product to CS and beyond.

Like the others mentioned here, its early and there’s a way to go but I would not in a month of Sundays guess that a business could achieve what this team has in 12 months. I now believe that with a little bit of Founder Mode, even the most stubborn of metrics can be flipped in short period of time.

If you’re at the bottom or you’ve seen the bottom, it isn’t over yet.

Go get’em.

Reminds me of the story of GeoSnapShot. Starting off focusing on solving event photography for mass participation/ large scale events, that entire industry shut down during the pandemic. I wrote down the value of my stake but I shouldn’t have written them off so quickly. Andy and the team executed a challenging pivot into a management platform for school yearbook photography in the US, and it worked. Now, mass events photography is back, and GeoSnapShot now has two major lines of business to run at, which adds to the resilience of revenue streams should either market get hit by another black swan event.

Great to see Pan killing it 🍔