The World Changes Slowly

... and so do we

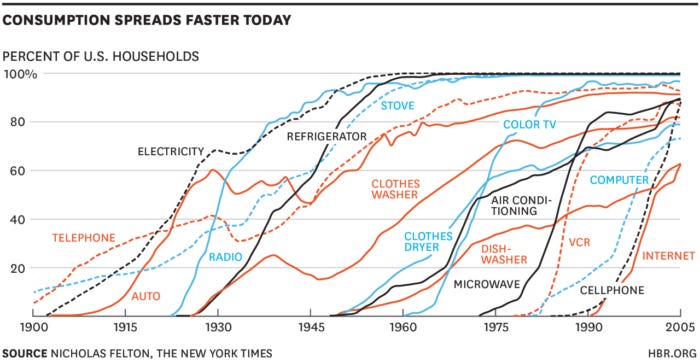

If you’ve read The Singularity, own a TV or have ever read a newspaper, you likely know that the speed at which technologies are adopted is accelerating.

‘EVP’ started investing in software in the 1990s (there was no EVP brand then). The first software investment by a person on our team was into HotelClub in 1996. They sold that business in 2005 and have since made many software investments.

A lot about how we invest has changed, but the changes are nuanced and less dramatic than you might expect in a world where some believe we have reached the end of the software era. In my view, the speed at which we have evolved our investment mandate is a fair reflection of the true speed at which the world changes. For example these days we:

invest in far fewer marketplaces than we once did - reflecting greater saturation in a vertical that historically had less technology related barriers to entry and thus evolved to be more competitive faster;

are somewhat less sensitive to the need for a global presence when we invest – reflecting the increasing ease with which software products can be exported today;

built an awesome internal talent function and an outbound origination function – reflecting the increasing demand for talent in Australia and increasing competition from our co-investors;

are ever more interested in long term defensibility, competition and product depth - reflecting ever lower barriers to entry and increasing competition from SaaS vendors;

have launched an Opportunities Fund which invests beyond Series A - targeting a gap in the funding market which didn’t exist when we started our first fund in 2016;

use various forms of ‘AI’ comprehensively in our own business and across our portfolio in many material functions.

… come to think of it, we haven’t changed all that much.

We still invest early stage, we still make a small number of high conviction bets, we still go ‘all in’ and lead all investments with a very high touch approach and if I am honest, we still look for many of the same fundamentals we always did, with some variations. We have changed slowly and we think that’s a good thing.

The increasing speed at which technologies are being adopted is undeniable but they are still adopted over many years. The crypto revolution is an evolution, it’s still going, slowly. One day we might decide to participate if we are confident in ‘the fundamentals’ but we don’t participate in revolutions. Genuine change on a global scale takes time and is an evolution requiring human change while a revolution is more likely to be a fad than a trend. We often ask ourselves if something is a trend or a fad and try to avoid the latter.

It is impossible to know for sure but I would guess that being open to change whilst changing slowly has been one of our greatest strength. This wouldn’t be an important attribute for all investors, some of which need to be more sensitive to short term volatility but as long term, ‘deep value’ investors looking for businesses with genuine intrinsic capacity for profitability (the true measure of value), we try to resist the urge to react to anxiety producing headlines looking for an immediate reaction.

We all saw the hype when Klarna shut down Salesforce as service provider with Workday slated to meet same fate amid AI initiatives. As SaaS investors, perhaps we should be alarmed, but we aren’t. We are evolving, but not alarmed. The reason for this is three fold:

despite obvious acceleration in the rate of change, people continue to underestimate the time it takes for new technologies to be adopted globally. Mostly, they overestimate the individual’s capacity to change even if technology itself evolves.

the manner of technology adoption is often not well understood in its early stages which can lead to inaccurate predictions about the impact of the technology.

People often look at current statistics to understand the impact of a technology without considering the change in those underlying statistics. For example, understanding the impact of the adoption of Uber whilst the adoption of smartphones itself was still in a state of flux could be misleading.

The evolution of television today is a good example of the latter point. From Wired Magazine to Nicholas Negroponte, futurists correctly predicted digital convergence and the idea that computers would transform undermine media consumption. Many predictions however failed to accurately foresee:

TV Evolved Instead of Shrinking: The rise of streaming services (e.g., Netflix, Amazon Prime) transformed how TV content is delivered, making on-demand viewing the norm. Many traditional networks of course have now adapted by developing their own streaming platforms (e.g., HBO Max, Disney+).

Smart TVs and Convergence: Rather than being replaced, TVs became computers in the form of smart TVs.

TV Production Adaptation: while cable subscriptions have crumbled, there has been a proliferation of subscription-based models, streaming, and premium content production. Networks like CBS, NBC, and even newer players like Netflix and Amazon became powerhouses in the production of high-quality, binge-able content. Today TV production has broadly adapted and in many ways improved both in terms of monetisation models and the manner of content production itself.

Ultimately television content remains a dominant cultural force. Even with the rise of digital platforms, the TV industry still commands vast audiences and advertising revenues, albeit through new platforms and methods.

The same will be true for software.

I believe that we will see a similar evolution of software in the AI age. No doubt, there will be casualties but ultimately, true change will come in the form of a slow(ish) and long term evolution, not an overnight revolution. This process of genuine change will give software vendors the opportunity to evolve with the technology, acting in some cases as a tailwind for the industry. Put another way, SaaS companies will often be the beneficiaries of the AI evolution as the market participants best position to leverage and incorporate the technology within their products. We already see this across our portfolio virtually all of which invest substantially in AI, often more than the pure play AI ‘disruptors’ themselves.

I hope our approach to change is sound. It has served us well to date.

Please considering sharing this if you enjoyed it. If not, feel free to tell me why.